Brief about service

When you have a GST registered business, it becomes compulsory for you to file GST returns on monthly/quarterly basis as applicable. Furnishing returns timely helps the authorities in carrying out taxpayer’s assessment. The GST return contains all the details pertaining to sales, purchases, tax collected on sales and tax paid on purchases that needs to be filed compulsorily by all registered taxpayers whether it be small or large.

Each GST return has been effectively designed to ensure a complete disclosure of information & transactions made between buyers and sellers during the period under consideration in front of authorities. Once you file the return, your tax liability will be calculated and you have to pay the amount that you owe the government.

At TaxWisey, we offer more transparency due to our tech-support availability. From registration to return filing, our experts can get everything done in a speedy and more hassle-free way. We take complete care of all your GST compliances and ensure that the returns are filed in a standardized format within the time limit so that you can focus on blooming your business.

Impact of Non/Late Filing

Being GST compliant is very crucial for every business. You will be liable to pay interest and a late fee if your GST return is not filed within the due date. As per the GST Law, the late fee is Rs.20-50/ day for CGST and SGST which can go maximum upto Rs.500-1000. This is however subject to changes as notified by the government. An offender who is not paying taxes or is making short payments can also be made liable to pay a penalty of 10% of the amount of tax due subject to a minimum of Rs.10,000.

Ignoring timely filing of GST returns may lead to arising unnecessary consequences and denying of certain facilities. For instance, rule 59(6) notifies that the GSTR-1 return filing facility will be blocked for taxpayers who have not filed GSTR-3B for the previous two return periods.

Further, If a person has not furnished the returns for a consecutive period of two tax periods , then the generation of E-Way Bill will be restricted for all types of outward supply of that individual/entity which can only be generated after successful filing of GST. In a few cases, GST registration can also be canceled by the authorities. Hence, it becomes crucial to every registered entity to adhere to the statutory compliance and complete all the necessary filings within the stipulated time-period.

Types Of GST Returns

There are separate GST returns required to be filed in various cases depending on your nature of work or registration type which are discussed below -

|

Form |

Who should file? |

Frequency |

|

GSTR-1 |

Every registered Individual or entity |

Monthly, or Quarterly (If opted under the QRMP scheme) |

|

GSTR-2A |

View-only Autofill form |

Monthly |

|

GSTR 2B |

View-only |

|

|

GSTR 3B |

Regular taxpayer |

Monthly, or Quarterly (If opted under the QRMP scheme) |

|

GSTR- 4 |

Composition dealer who has opted composition scheme |

Annually |

|

GSTR-5 |

Non-resident foreigners who have businesses in India |

Annually |

|

GSTR-5A |

Non-resident OIDAR service providers |

Annually |

|

GSTR-6 |

Input Service Distributor (ISD) |

Annually |

|

GSTR-7 |

Individuals who need to deduct TDS under GST |

Annually |

|

GSTR-8 |

E-commerce operators |

Annually |

|

GSTR-9 |

Every registered taxpayer |

Annually |

|

GSTR 9C |

Every registered taxpayer |

Annually |

|

GSTR-10 |

People whose registration has been canceled or surrendered |

Once, when GST registration is canceled or surrendered. |

|

GSTR-11 |

By foreign diplomatic missions and embassies for refund claim |

Monthly |

Advantages of service

Ease & flexibility

Filing GST Return is an online process to keep financial transactions accountable and provides the benefit of the ease of access and flexibility.

Simple Procedure

The process of filing a GST return is online. At TaxWisey, you only require a list of receipts, invoices, and bills to be kept handy and the remaining tasks will be taken up by our in-house experts.

Avoids Unnecessary fines & penalties

Timely filing your GST return guards you from facing unnecessary consequences like interest, monetary penalties, recovery, suspension of GSTIN and other strict provisions.

Organized Procedure

GST has brought in accountability and regulation to various industries through making its return filing procedure smooth and organized.

Enhances taxpayers’ credibility

Timely and proper filing of GST return benefits taxpayers at the time of seeking loans from a bank or financial institution. Taxpayer’s credibility is evaluated based on his GST returns filing record.

Subsuming of Taxes

GST being a unified and singular tax regime has lessened the number of filings hence making it less hassle for small entities to fear of maintaining compliance contrary to pre-GST time where businesses had to file multiple returns accorded with different indirect taxes.

Ease & flexibility

Filing GST Return is an online process to keep financial transactions accountable and provides the benefit of the ease of access and flexibility.

Simple Procedure

The process of filing a GST return is online. At TaxWisey, you only require a list of receipts, invoices, and bills to be kept handy and the remaining tasks will be taken up by our in-house experts.

Avoids Unnecessary fines & penalties

Timely filing your GST return guards you from facing unnecessary consequences like interest, monetary penalties, recovery, suspension of GSTIN and other strict provisions.

Organized Procedure

GST has brought in accountability and regulation to various industries through making its return filing procedure smooth and organized.

Enhances taxpayers’ credibility

Timely and proper filing of GST return benefits taxpayers at the time of seeking loans from a bank or financial institution. Taxpayer’s credibility is evaluated based on his GST returns filing record.

Subsuming of Taxes

GST being a unified and singular tax regime has lessened the number of filings hence making it less hassle for small entities to fear of maintaining compliance contrary to pre-GST time where businesses had to file multiple returns accorded with different indirect taxes.

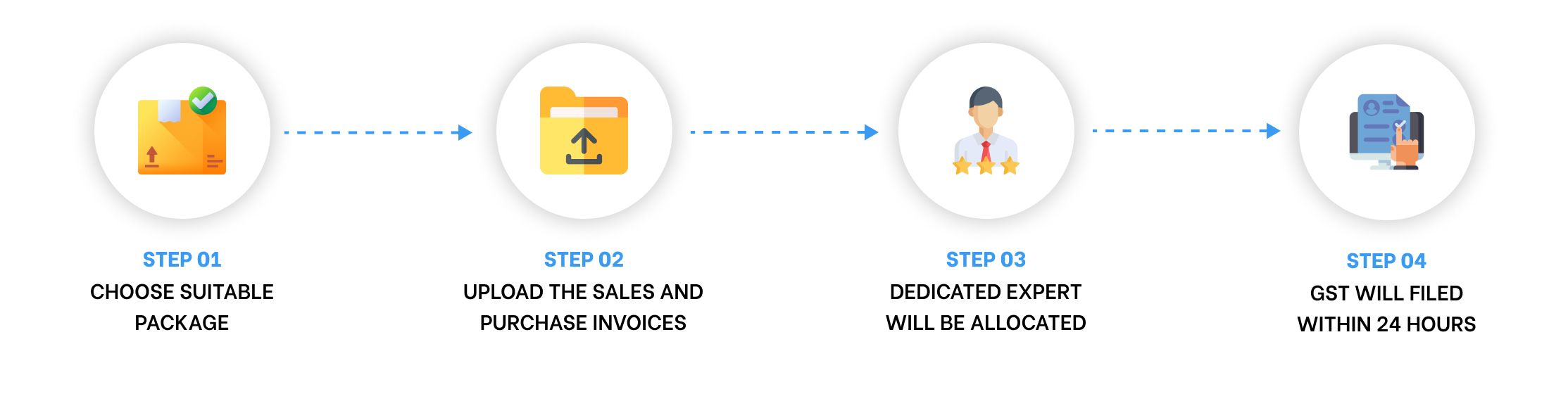

Quickest way for GST Filing

Day 1

We will collect your Sale and Purchase data and start the working

Day 2

After working on the data we will call and inform you about the tax due if any and file your GST

Day 2

After working on the data we will call and inform you about the tax due if any and file your GST

Day 1

We will collect your Sale and Purchase data and start the working

Day 2

After working on the data we will call and inform you about the tax due if any and file your GST

Day 2

After working on the data we will call and inform you about the tax due if any and file your GST

How it works

Plans

Basic

- Upto 10 invoices (Sales )

- Turnover upto 50 Lacs

- Dedicated GST Expert

- GST Tax Payment Assistance

- Input Tax RECONCILIATION

- Regular Alerts on GST Filing due dates

- Support on GST Query

Premium

- Upto 20 invoices (Sales)

- Turnover upto 1 CR

- Dedicated GST Expert

- GST Tax Payment Assistance

- Input Tax RECONCILIATION

- Regular Alerts on GST Filing due dates

- Support on GST Query

Gold

- Upto 30 invoices (Sales)

- Turnover upto 1.5 CR

- Dedicated GST Expert

- GST Tax Payment Assistance

- Input Tax RECONCILIATION

- Regular Alerts on GST Filing due dates

- Support on GST Query

Testimonials

Check out some of our Client ReviewsAll your Questions answered in one place

Why choose us

End to End Solution

TaxWisey offers you end-to-end solution to all your tax and business compliance problems with the help of our in-house tax experts in an user-friendly, comfortable and secure environment so that you can take the utmost advantage of the same

Affordable Prices

Usually, “professional” is inferred as “costly,” but this is not not the case at TaxWisey! By Giving us an opportunity to serve, you would be considering it as an additional cost, but on the contrary we can actually save lots of money for our clients.

Quick Support

You can connect with our customer support team to get assistance and clear your tax and finance related queries. Drop us a call for FREE Consultation anytime.

Timely Returns

Our assets are our clients. Our talented, resourceful and spirited people are the very best technically in terms of competence, always with an eye towards service and timeliness. That is our guarantee.

Accuracy

Our services are tailored in line professional ethics and confidentiality to simplify finances, save money and time. Every piece of work is checked for completeness and accuracy. The data entered goes through a robust system of scrutiny designed by our experts.

Tax Filing Guidance

A highly automated and user-friendly interface to ease your tax return preparation and filing. Our experts ensure that you get the maximum possible tax refund and exemption and do not pay more than you owe.

No Hidden charge

The charges of our mentioned services shall be inclusive of all overhead costs and there are no other expenses or costs involved of any nature. We reassure you that we stick to the fees we quote and there are no hidden costs.

Privacy

Our platform has several security layers that keep your data safe & secure. We strictly adhere to legal guidelines of data security and make sure that is given top priority.

Money Back Guarantee

Our money back introductory scheme clearly indicates our unselfishness. We value our clients' satisfaction and hence, we offer further refunds if we are for some reasons, unable to cohere to the annual timetable as per commitment.