Brief about service

General Partnership is registered with an association of two or more partners. The partners can be individuals, businesses, interest-based organizations, schools or government institutions who wish to carry on the business together by combining their financial resources,managerial abilities and skills. General partnership businesses are governed under the Indian Partnership Act 1932. The partners agree to cooperate to advance their mutual interests and are free to decide on various terms like sharing of profits, rights and duties by executing a partnership deed

Taxwisey has drafting experts, legal advisors, professional CAs having in-hand expertise in their particular field who are always there to offer full assistance with the partnership registration process at the lowest possible price. Our experts will be preparing/drafting your partnership deed at your terms and conditions and take care of all legal formalities and fulfill the compliances, as defined by the law.

What is a Partnership Deed?

Partnership Deed is a contract formed between the partners of a partnership firm which lays down and mentions all the rights, duties and other formalities regarding the partners and the company. To prevent future misunderstandings, the partnership agreement must specifically state how financial resources, task management, profits/losses will be distributed among the partners. It is like the constitution of a country

Features Of General Partnership

➤ Minimum 2 people are required to start a partnership firm and the maximum limit is 10 for banking business and 20 in case of all other types of business.

➤ The partnership deed duly signed by all partners governs the operation, management, business methodologies and other business-related activities.

➤ Sharing of Profits and losses are done in accordance with any ratio as agreed.

➤ Partners have unlimited liability and are jointly held liable for the debts and losses of the firm.

➤ No distinct legal status of the firm.

➤ Partner must be competent enough to enter into the partnership agreement. He/She should not be a minor, or of unsound mind or insolvent or disqualified by law.

➤ Partnership can be dissolved by agreement, mutual consent, insolvency, or uncertain contingencies.

Advantages of service

A simple and straightforward procedure

General Partnership firms are easy to form since no complex business formalities are required to be fulfilled.

Flexibility Of Changes

Partnership firms have flexibility of changes which cannot be implemented in a company with ease because of the restrictions

Simple to Begin

Registering to a partnership firm is seen as a fantastic way to kickstart your business journey. In most cases, a partnership deed registration is the only necessity for register partnership firms in india.

Legal Recognition

The partnership will be legally recognized which will indirectly help in getting more consumer trust and enhance its potential to expand.

Simple Compliance

There is no legal difference between a partnership business and its partners for the calculation of tax liability. The assets and liabilities of partnership firms are the assets and liabilities of its partners. Hence, there is no need to file separate returns for the company and its partners. You don’t have to be saddled with compliance work

Sharing of risk lessens the burden in case of losses.

By working in partnership you can get benefits like companionship and mutual support. This is much better than operating on your own as a sole trader. Starting and managing a business alone can feel stressful and daunting after a particular time period.

Diverse expertise of partners which can be utilized to achieve goals efficiently.

Partners can share business tasks based on their own knowledge, skills, experience. So if one partner has a technical expertise, they could focus on technical related tasks, while another may have sales and marketing background and therefore can take ownership of that side. This type of coordination will provide a better chance of success.

Less burden of statutory compliance

A partnership firm need not submit an annual return to the Ministry of Corporate Affairs. Also, partnership firms need not get its account audited.However, the same book could be required by the IT Department to fulfill the need of the law.

Easy and quick dissolution process

Partnership can be dissolved by agreement, mutual consent, insolvency, or uncertain contingencies.

Job Creation

Sole Proprietorship being the oldest, most accessible, and straightforward business structure can also lead to many of the benefits associated with job creation.

A simple and straightforward procedure

General Partnership firms are easy to form since no complex business formalities are required to be fulfilled.

Flexibility Of Changes

Partnership firms have flexibility of changes which cannot be implemented in a company with ease because of the restrictions

Simple to Begin

Registering to a partnership firm is seen as a fantastic way to kickstart your business journey. In most cases, a partnership deed registration is the only necessity for register partnership firms in india.

Legal Recognition

The partnership will be legally recognized which will indirectly help in getting more consumer trust and enhance its potential to expand.

Simple Compliance

There is no legal difference between a partnership business and its partners for the calculation of tax liability. The assets and liabilities of partnership firms are the assets and liabilities of its partners. Hence, there is no need to file separate returns for the company and its partners. You don’t have to be saddled with compliance work

Sharing of risk lessens the burden in case of losses.

By working in partnership you can get benefits like companionship and mutual support. This is much better than operating on your own as a sole trader. Starting and managing a business alone can feel stressful and daunting after a particular time period.

Diverse expertise of partners which can be utilized to achieve goals efficiently.

Partners can share business tasks based on their own knowledge, skills, experience. So if one partner has a technical expertise, they could focus on technical related tasks, while another may have sales and marketing background and therefore can take ownership of that side. This type of coordination will provide a better chance of success.

Less burden of statutory compliance

A partnership firm need not submit an annual return to the Ministry of Corporate Affairs. Also, partnership firms need not get its account audited.However, the same book could be required by the IT Department to fulfill the need of the law.

Easy and quick dissolution process

Partnership can be dissolved by agreement, mutual consent, insolvency, or uncertain contingencies.

Job Creation

Sole Proprietorship being the oldest, most accessible, and straightforward business structure can also lead to many of the benefits associated with job creation.

Quickest way for Partnership registration

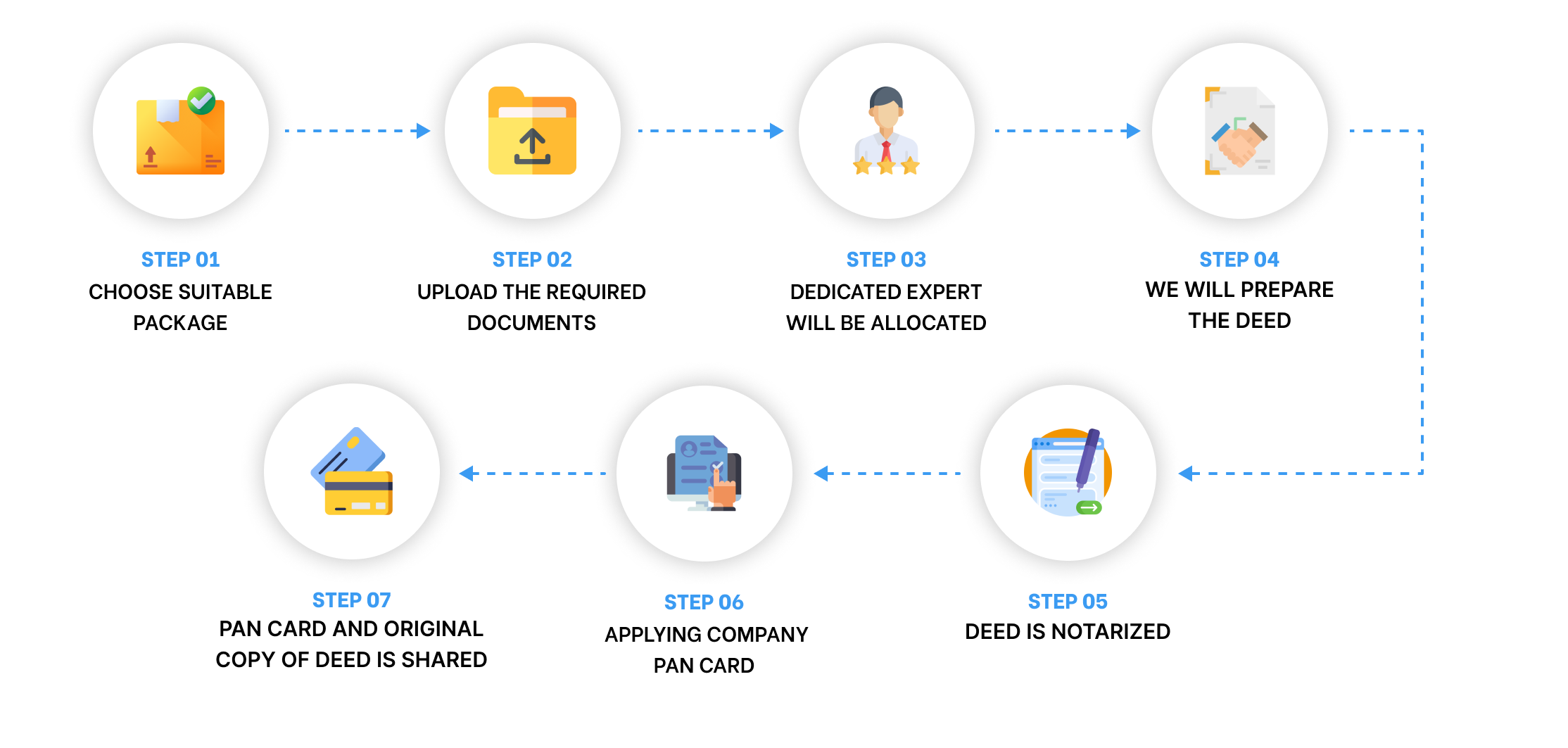

Day 1

We’ll prepare the Partnership Deed outlining the terms and conditions of partnership.

Day 2

We get the Deed Notarised

Day 3

The deed is delivered to you via courier.

Day 4-5

Customer Sends back signed copy of the scanned documents.

Day 6

We apply for PAN Card and submit it along with necessary documents.

Day 13-14

You received your PAN card and partnership company is created.

Day 1

We’ll prepare the Partnership Deed outlining the terms and conditions of partnership.

Day 2

We get the Deed Notarised

Day 3

The deed is delivered to you via courier.

Day 4-5

Customer Sends back signed copy of the scanned documents.

Day 6

We apply for PAN Card and submit it along with necessary documents.

Day 13-14

You received your PAN card and partnership company is created.

How it works

Plans

Basic

- Partnership Deed Drafting

- Notary Charges

- Pan Card Application

Premium

- Partnership Deed Drafting

- Notary Charges

- Pan Card Application

- GST Registration

- Bank Opening Support

Gold

- Partnership Deed Drafting

- Notary Charges

- Pan Card Application

- GST Registration

- 3 Months GST Filing

- Bank Opening Support

- MSME Registration Certificate

Testimonials

Check out some of our Client ReviewsAll your Questions answered in one place

Why choose us

End to End Solution

TaxWisey offers you end-to-end solution to all your tax and business compliance problems with the help of our in-house tax experts in an user-friendly, comfortable and secure environment so that you can take the utmost advantage of the same

Affordable Prices

Usually, “professional” is inferred as “costly,” but this is not not the case at TaxWisey! By Giving us an opportunity to serve, you would be considering it as an additional cost, but on the contrary we can actually save lots of money for our clients.

Quick Support

You can connect with our customer support team to get assistance and clear your tax and finance related queries. Drop us a call for FREE Consultation anytime.

Timely Returns

Our assets are our clients. Our talented, resourceful and spirited people are the very best technically in terms of competence, always with an eye towards service and timeliness. That is our guarantee.

Accuracy

Our services are tailored in line professional ethics and confidentiality to simplify finances, save money and time. Every piece of work is checked for completeness and accuracy. The data entered goes through a robust system of scrutiny designed by our experts.

Tax Filing Guidance

A highly automated and user-friendly interface to ease your tax return preparation and filing. Our experts ensure that you get the maximum possible tax refund and exemption and do not pay more than you owe.

No Hidden charge

The charges of our mentioned services shall be inclusive of all overhead costs and there are no other expenses or costs involved of any nature. We reassure you that we stick to the fees we quote and there are no hidden costs.

Privacy

Our platform has several security layers that keep your data safe & secure. We strictly adhere to legal guidelines of data security and make sure that is given top priority.

Money Back Guarantee

Our money back introductory scheme clearly indicates our unselfishness. We value our clients' satisfaction and hence, we offer further refunds if we are for some reasons, unable to cohere to the annual timetable as per commitment.