Brief about service

About

A Private Ltd Company is a legal entity registered and formed under the 1956 Companies Act. It lies somewhere between a partnership and a widely owned public company. It is the most common type of legal entity that is preferred by millions of Indian businesses. The company can be registered with a minimum of two directors and a maximum of fifteen. A person can be both a director and shareholder. But at least one Director should be a resident Indian citizen. Further, the company should have a minimum authorized capital of Rs. 1 lakh.

Registering your company becomes extremely important and the same should be done very thoroughly with a broad brain. It does involve some technical aspects and also certain legalities which if avoided can attract a wide pool of unwanted headaches. TaxWisey offers you expert assistance in registering your company at the best possible price. We take care of all legal formalities and fulfill the compliances as per the law thus saving your precious time and energy. From getting Director Identification Number and Digital Signature Certificate, Drafting of MoA & AoA, Obtaining company’s PAN and TAN to finally getting the incorporation certificate, we will always be with you till the very end.

Key Features

- Separate Legal Entity: A Private Limited Company is considered to be a separate legal entity from its owners and can sue or be sued in its own name.

- Limited Liability: The liability of the shareholders is limited to the amount of capital they have invested in the company.

- Transferability of Shares: The shares of a Private Limited Company are freely transferable, subject to certain restrictions as per the articles of association.

- Minimum number of shareholders: A Private Limited Company must have a minimum of two shareholders and a maximum of 200.

- Minimum Capital Requirements: There is no minimum capital requirement for the incorporation of a Private Limited Company.

Advantages of service

Legal Recognition

Upon registration, the company gets legal recognition which is separate from its directors, shareholders or members. This adds in more customer attraction and greater stability.

Building credibility

Registering a private limited company gives a professional image to businesses, which can be important when attracting new customers or investors which increases its potential to grow big and expand at the same time building credibility in the market.

Continuous Existence or perpetual succession

A private limited company having a separate legal recognition, is unaffected by the death or other departure of any member. It continues to be in existence irrespective of the changes in membership.

Limited Liability

Registering your company shields your business from personal liability and protects you from other risks and losses. This protection is very essential for the shareholders and directors as it limits their liability. It means in case your company goes into debt or bankruptcy, creditors cannot seek direct payment from the personal assets of company owners.

Ease in raising capital

Private limited companies are becoming increasingly popular as they attract investors into the business more due to their credibility. This can be done through issuing new shares, taking out loans, or issuing bonds. In addition, it is often easier to approach high net-worth individuals for funding when operating under a private limited company.

Better Borrowing Power

A Private company has better avenues for borrowing funds. It can issue debentures, secured as well as unsecured and can also accept deposits from various sources. Even banking and financial institutions prefer to render financial assistance to a private company.

Legal Recognition

Upon registration, the company gets legal recognition which is separate from its directors, shareholders or members. This adds in more customer attraction and greater stability.

Building credibility

Registering a private limited company gives a professional image to businesses, which can be important when attracting new customers or investors which increases its potential to grow big and expand at the same time building credibility in the market.

Continuous Existence or perpetual succession

A private limited company having a separate legal recognition, is unaffected by the death or other departure of any member. It continues to be in existence irrespective of the changes in membership.

Limited Liability

Registering your company shields your business from personal liability and protects you from other risks and losses. This protection is very essential for the shareholders and directors as it limits their liability. It means in case your company goes into debt or bankruptcy, creditors cannot seek direct payment from the personal assets of company owners.

Ease in raising capital

Private limited companies are becoming increasingly popular as they attract investors into the business more due to their credibility. This can be done through issuing new shares, taking out loans, or issuing bonds. In addition, it is often easier to approach high net-worth individuals for funding when operating under a private limited company.

Better Borrowing Power

A Private company has better avenues for borrowing funds. It can issue debentures, secured as well as unsecured and can also accept deposits from various sources. Even banking and financial institutions prefer to render financial assistance to a private company.

Quickest way for Private Ltd Company Registration! Register Your Private Limited Company Online | Fast & Hassle-Free – Tax Wisey

Day 1

We make an application for name approval of your entity.

Day 2

Applying for Digital Signature Certificate (DSC) for both Directors

Day 3

Preparation of required forms is done.

Day 4

We’ll Submit an application for the incorporation certificate.

Day 10-14

We provide you with your Certificate of Incorporation.

Day 1

We make an application for name approval of your entity.

Day 2

Applying for Digital Signature Certificate (DSC) for both Directors

Day 3

Preparation of required forms is done.

Day 4

We’ll Submit an application for the incorporation certificate.

Day 10-14

We provide you with your Certificate of Incorporation.

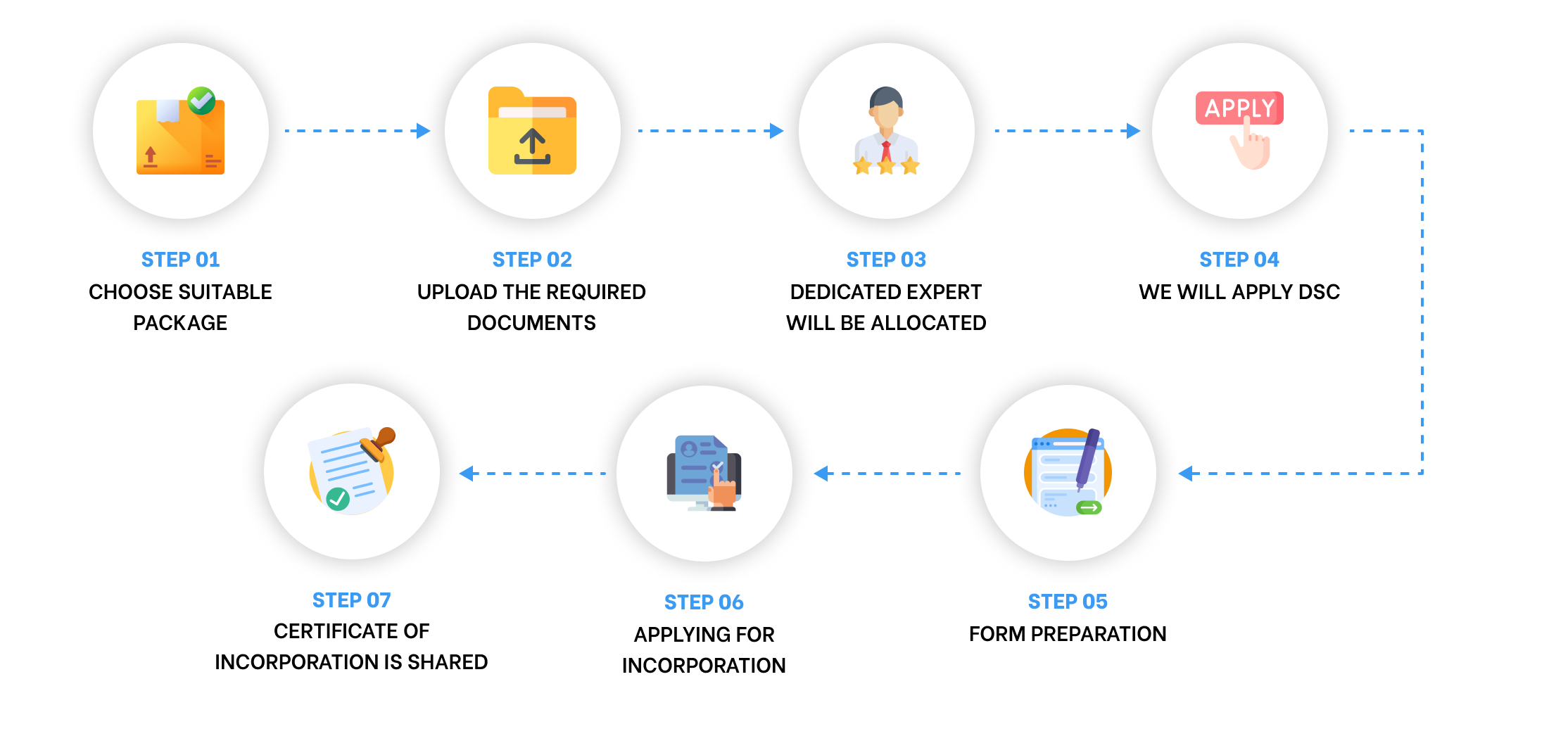

How it works

Plans

Basic

- Certificate of Incorporation

- CIN Number

- 2 Name Approval Run

- UPTO 1 Lakh Capital

- Incorporation Fees

- PAN

- TDS Registration

- Certificate of Commencement of Business

- 2 Digital Signature

- GST Registration

- MSME Registration

- AOA

- MOA

- ESIC

- EPFO

- *Stamp duty charges applicable as per the state

Testimonials

Check out some of our Client ReviewsAll your Questions answered in one place

Why choose us

End to End Solution

TaxWisey offers you end-to-end solution to all your tax and business compliance problems with the help of our in-house tax experts in an user-friendly, comfortable and secure environment so that you can take the utmost advantage of the same

Affordable Prices

Usually, “professional” is inferred as “costly,” but this is not not the case at TaxWisey! By Giving us an opportunity to serve, you would be considering it as an additional cost, but on the contrary we can actually save lots of money for our clients.

Quick Support

You can connect with our customer support team to get assistance and clear your tax and finance related queries. Drop us a call for FREE Consultation anytime.

Timely Returns

Our assets are our clients. Our talented, resourceful and spirited people are the very best technically in terms of competence, always with an eye towards service and timeliness. That is our guarantee.

Accuracy

Our services are tailored in line professional ethics and confidentiality to simplify finances, save money and time. Every piece of work is checked for completeness and accuracy. The data entered goes through a robust system of scrutiny designed by our experts.

Tax Filing Guidance

A highly automated and user-friendly interface to ease your tax return preparation and filing. Our experts ensure that you get the maximum possible tax refund and exemption and do not pay more than you owe.

No Hidden charge

The charges of our mentioned services shall be inclusive of all overhead costs and there are no other expenses or costs involved of any nature. We reassure you that we stick to the fees we quote and there are no hidden costs.

Privacy

Our platform has several security layers that keep your data safe & secure. We strictly adhere to legal guidelines of data security and make sure that is given top priority.

Money Back Guarantee

Our money back introductory scheme clearly indicates our unselfishness. We value our clients' satisfaction and hence, we offer further refunds if we are for some reasons, unable to cohere to the annual timetable as per commitment.