Brief about service

Every business or entity that is involved in the buying and selling of goods/services have to register for GST. It is mandatory for companies whose turnover exceeds the threshold limit of Rs 40 lakhs for trading and manufacturing or 20 lakhs for service industry (Rs 10 lakhs for special category states), to register as a normal taxable person. If authorities get to know that a business fulfilling the eligibility is carrying its operations without registering to GST, there could be major consequences arising which include penalties, creating a negative image on authorities about the trustworthiness, attracting frequent checks, or any other unwanted issues. That’s why it becomes imperative to adhere to the GST rules.

Compulsory Registration

- All individuals/entity that are obliged to get registration under GST include -

- All Entities/Casual Taxable persons making Interstate Taxable supply and whose turnover exceeds Rs 40 lakhs (for trading and manufacturing) or 20 lakhs for service (Rs 10 lakhs for special category states)

- Non-Resident Taxable persons making Taxable supply.

- E-commerce operator.

- Agents of a supplier making supply on behalf of a taxable person.

- Persons required to pay tax under Reverse Charge scheme.

Exemptions under GST

- The following people and entities are not bound under obligation to get registration mandatorily:

- Agriculturalists.

- Activities that do not come under the supply of goods or services. (Examples - sale of a building or land, and services provided by an employee.)

- Businesses that make non-GST/ non-taxable supplies. (Examples - aviation turbine fuel, electricity, natural gas, high-speed diesel, and petrol.)

- Businesses that make exempt/ nil-rated supplies.

- Businesses that do not fall under the threshold exemption limit.

Advantages of service

Unified Tax Regime

The amalgamation of a large number of taxes which was levied at a central and state level into a single tax have far-reaching benefits that are both business & consumer-friendly which is bound to make a positive impact on you and your business.

Lesser compliance

Implementation of GST has altered the complicated indirect tax framework. It has completely changed the way how tax is paid. As GST is a unified and singular tax regime, the number of filings has come down, making it less hassle for small entities to fear of maintaining compliance contrary to the earlier previous tax regime where businesses had to file multiple returns accorded with different indirect taxes.

ITC Claiming Facility

By getting registered, businesses can avail ITC benefits by claiming the Input tax credit on the purchase of goods & services & can utilize the same for payment of taxes due on supply of goods or services. Only Registered persons can avail the facility of claiming ITC on the purchase of goods & services.

Uniform Tax Rates and structure

GST has a view of making a neutral tax regime where every business stands equally in front of authorities irrespective of the choice or place of doing business. Thus the GST tax rates and structures are similar across the country.

Unified Tax Regime

The amalgamation of a large number of taxes which was levied at a central and state level into a single tax have far-reaching benefits that are both business & consumer-friendly which is bound to make a positive impact on you and your business.

Lesser compliance

Implementation of GST has altered the complicated indirect tax framework. It has completely changed the way how tax is paid. As GST is a unified and singular tax regime, the number of filings has come down, making it less hassle for small entities to fear of maintaining compliance contrary to the earlier previous tax regime where businesses had to file multiple returns accorded with different indirect taxes.

ITC Claiming Facility

By getting registered, businesses can avail ITC benefits by claiming the Input tax credit on the purchase of goods & services & can utilize the same for payment of taxes due on supply of goods or services. Only Registered persons can avail the facility of claiming ITC on the purchase of goods & services.

Uniform Tax Rates and structure

GST has a view of making a neutral tax regime where every business stands equally in front of authorities irrespective of the choice or place of doing business. Thus the GST tax rates and structures are similar across the country.

Quickest way for GST Registration Online | Hassle-Free GST Filing & Compliance

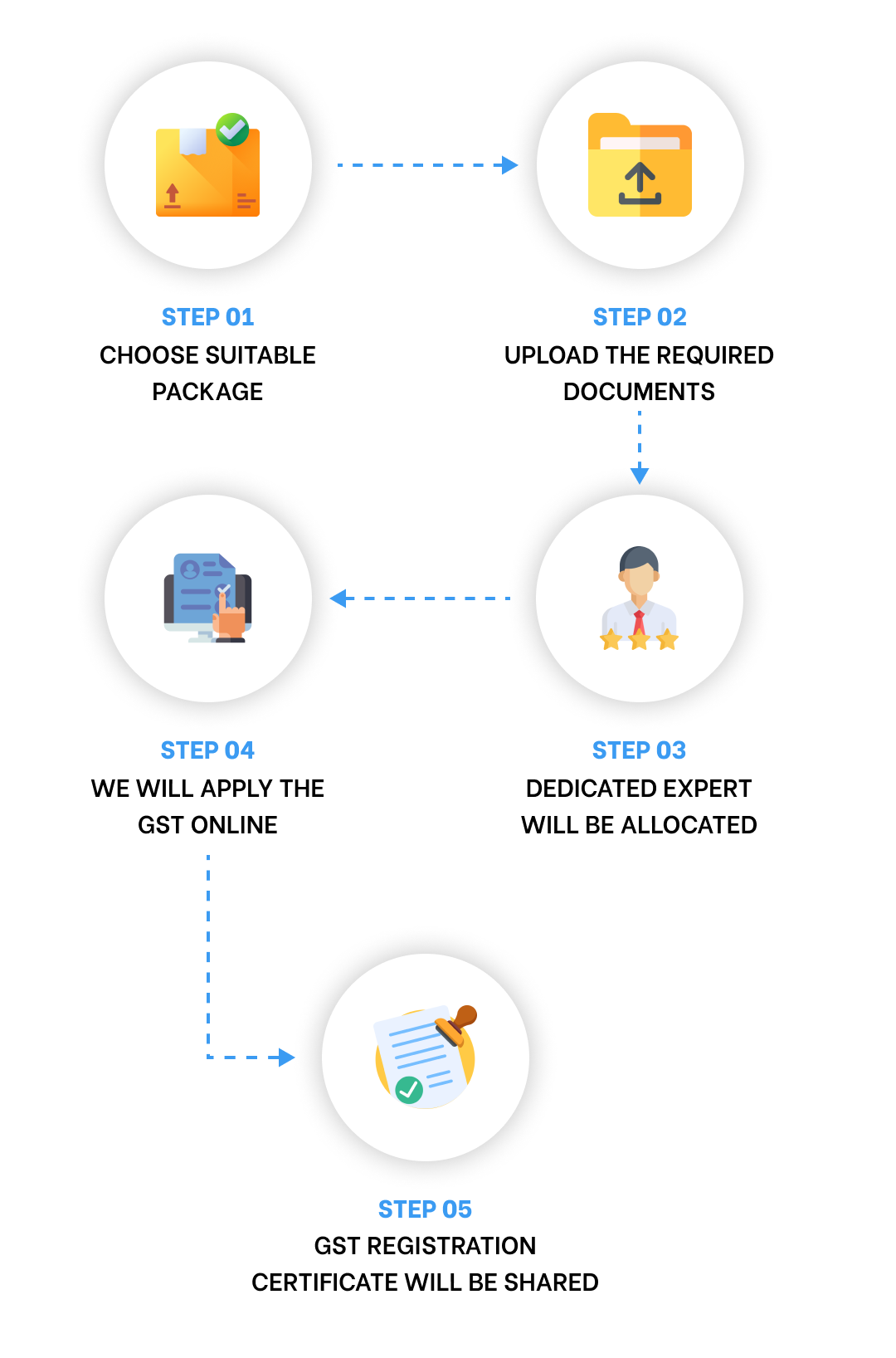

Preparation of application

We will collect the documents and prepare the online application

Registration on portal

We will apply the GST Registration on the portal and will provide you ARN number to Track application

Sharing GST Certificate

We will share your GST Certificate with you

Preparation of application

We will collect the documents and prepare the online application

Registration on portal

We will apply the GST Registration on the portal and will provide you ARN number to Track application

Sharing GST Certificate

We will share your GST Certificate with you

How it works

Plans

Basic plan

- GST Registration Certificate

- GST Filing for 3 Months

- GST Invoice Format

- E-Way Bill Portal Registration

- Rent Agreement and NOC Drafting

- Business bank account opening support

Premium plan

- GST Registration Certificate

- GST Filing for 3 Months

- GST Invoice Format

- E-Way Bill Portal Registration

- Rent Agreement and NOC Drafting

- Business bank account opening support

- 30 minutes of GST Consultation

- LUT Application ( for exports )

- MSME Registration

Gold plan

- GST Registration Certificate

- MSME Registration Certificate

- Import Export Code Registration

- GST Filing for 3 Months

- GST Invoice Format

- E-Way Bill Portal Registration

- Rent Agreement and NOC Drafting

- Business bank account opening support

- 30 minutes of GST Consultation

- LUT Application ( for exports )

Testimonials

Check out some of our Client ReviewsAll your Questions answered in one place

Why choose us

End to End Solution

TaxWisey offers you end-to-end solution to all your tax and business compliance problems with the help of our in-house tax experts in an user-friendly, comfortable and secure environment so that you can take the utmost advantage of the same

Affordable Prices

Usually, “professional” is inferred as “costly,” but this is not not the case at TaxWisey! By Giving us an opportunity to serve, you would be considering it as an additional cost, but on the contrary we can actually save lots of money for our clients.

Quick Support

You can connect with our customer support team to get assistance and clear your tax and finance related queries. Drop us a call for FREE Consultation anytime.

Timely Returns

Our assets are our clients. Our talented, resourceful and spirited people are the very best technically in terms of competence, always with an eye towards service and timeliness. That is our guarantee.

Accuracy

Our services are tailored in line professional ethics and confidentiality to simplify finances, save money and time. Every piece of work is checked for completeness and accuracy. The data entered goes through a robust system of scrutiny designed by our experts.

Tax Filing Guidance

A highly automated and user-friendly interface to ease your tax return preparation and filing. Our experts ensure that you get the maximum possible tax refund and exemption and do not pay more than you owe.

No Hidden charge

The charges of our mentioned services shall be inclusive of all overhead costs and there are no other expenses or costs involved of any nature. We reassure you that we stick to the fees we quote and there are no hidden costs.

Privacy

Our platform has several security layers that keep your data safe & secure. We strictly adhere to legal guidelines of data security and make sure that is given top priority.

Money Back Guarantee

Our money back introductory scheme clearly indicates our unselfishness. We value our clients' satisfaction and hence, we offer further refunds if we are for some reasons, unable to cohere to the annual timetable as per commitment.